Biometric Verification for JazzCash and EasyPaisa Users: A Secure Step Forward from July 1, 2025

Biometric verification for JazzCash and EasyPaisa users will become mandatory from July 1, 2025. This new requirement marks a significant change in how Pakistan’s mobile wallet services will operate, aiming to bolster security and reduce the risks associated with fraudulent activities. As digital financial transactions continue to rise in Pakistan, JazzCash and EasyPaisa have taken the initiative to ensure that their services remain secure and trustworthy for all users. In this article, we’ll explore why biometric verification for JazzCash and EasyPaisa users is being implemented, the steps involved, and the impact it will have on users.

Why is Biometric Verification for JazzCash and EasyPaisa Users Becoming Mandatory?

With the rapid growth of mobile wallet services, digital fraud has also seen an increase. Mobile wallets like JazzCash and EasyPaisa offer unparalleled convenience for users, but this convenience has also attracted fraudulent activities such as identity theft and unauthorized transactions. In response to these security concerns, the State Bank of Pakistan (SBP) has issued directives to ensure that mobile financial services maintain the highest standards of security. Learn more about SBP’s regulations on mobile wallet services.

Biometric verification for JazzCash and EasyPaisa users is being introduced as an additional layer of security to authenticate a user’s identity. By using biometric data like fingerprints or facial recognition, both JazzCash and EasyPaisa aim to ensure that only the account owner can access their wallet and perform financial transactions. This shift is expected to drastically reduce the chances of unauthorized access and fraud.

How Does Biometric Verification for JazzCash and EasyPaisa Users Work?

Biometric verification for JazzCash and EasyPaisa users involves associating your account with your unique biometric data. This data is captured using your mobile device’s fingerprint scanner or through facial recognition technology. Once linked, any financial transaction or activity performed through these services will require biometric verification, ensuring the identity of the user.

For those who have already used biometric verification for other services, the process is relatively simple and easy to complete. It enhances security while providing a seamless user experience. The biometric data is stored securely, and only the service provider can use it for verification purposes. The data will not be shared with any third parties, ensuring the privacy of the users. For more information on biometric data security, check out this guide on biometric security.

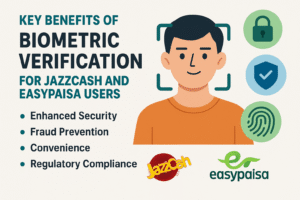

Key Benefits of Biometric Verification for JazzCash and EasyPaisa Users

1. Improved Security for JazzCash and EasyPaisa Users

The primary benefit of biometric verification for JazzCash and EasyPaisa users is the enhanced security it offers. Traditional security methods, such as PINs or passwords, can be easily compromised or forgotten. In contrast, biometric data is unique to the individual and cannot be replicated or guessed. This ensures that only the account owner can access the wallet and perform transactions, providing an extra layer of security against fraud. Learn about biometric security systems.

2. Compliance with Regulatory Standards for JazzCash and EasyPaisa Users

Pakistan’s central bank, the State Bank of Pakistan (SBP), has been actively working to regulate mobile financial services to ensure they meet high security and privacy standards. By implementing biometric verification for JazzCash and EasyPaisa users, JazzCash and EasyPaisa comply with the SBP’s regulations, which are aimed at enhancing the security of mobile wallets and digital financial services across the country. The adoption of biometric verification is in line with global best practices for secure digital payments. Explore SBP’s guidelines on digital financial services.

3. Convenience and Accessibility for JazzCash and EasyPaisa Users

With the biometric verification for JazzCash and EasyPaisa users process integrated into the mobile apps of both JazzCash and EasyPaisa, users can complete the verification process from the comfort of their homes. This eliminates the need for users to visit physical outlets or agents for biometric registration. As long as your device supports biometric authentication, you can verify your identity and start using the services securely and seamlessly.

4. Better Control Over Transactions for JazzCash and EasyPaisa Users

By requiring biometric verification for JazzCash and EasyPaisa users transactions, JazzCash and EasyPaisa give users more control over their accounts. Each transaction will need authentication, and users can monitor and confirm each financial activity with their biometric credentials, reducing the risk of unauthorized transactions. This level of control ensures peace of mind for users, knowing that their funds are well-protected.

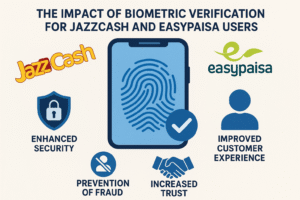

The Impact of Biometric Verification for JazzCash and EasyPaisa Users

Starting from July 1, 2025, all JazzCash and EasyPaisa users will need to complete their biometric verification to continue using the services. This requirement will apply to a wide range of activities, from cash deposits and withdrawals to mobile payments and transfers. Users who fail to complete the biometric verification may face restrictions on their accounts, limiting their ability to perform transactions.

Although there have been rumors circulating about users losing access to their funds if they do not complete the biometric verification, no official statement has confirmed such claims. However, it is clear that failing to complete the verification could result in temporary restrictions or an inability to access certain services, making it imperative for all users to complete the process promptly.

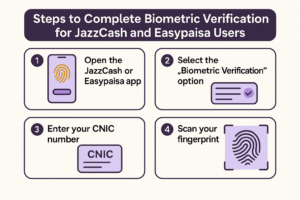

Steps to Complete Biometric Verification for JazzCash and EasyPaisa Users

Both JazzCash and EasyPaisa have made the process of biometric verification simple and convenient. Here’s how users can complete the verification:

For JazzCash Users:

-

Open the JazzCash app on your mobile device.

-

Go to the “Biometric Verification” section from the settings menu.

-

Follow the on-screen instructions to scan your fingerprint or use facial recognition.

-

Once verified, you will be able to perform transactions securely and conveniently.

For EasyPaisa Users:

-

Launch the EasyPaisa app on your phone.

-

Navigate to the “Biometric Verification” option under account settings.

-

Follow the instructions to scan your fingerprint or use facial recognition for verification.

-

Upon successful verification, you can start using the app for transactions.

If you encounter any issues during the biometric verification process, both JazzCash and EasyPaisa provide customer support teams that can assist you with troubleshooting and resolving any problems.

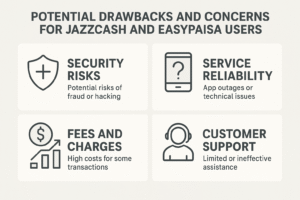

Potential Drawbacks and Concerns for JazzCash and EasyPaisa Users

While biometric verification for JazzCash and EasyPaisa users enhances security, there are some concerns regarding the system. One potential issue is the accuracy of biometric recognition, which may not work properly for all users. In cases where fingerprint scans or facial recognition fail, users may experience difficulties accessing their accounts.

Additionally, there are privacy concerns regarding the storage of biometric data. Both JazzCash and EasyPaisa have assured users that their biometric data will be stored securely and used exclusively for verification purposes. However, users who are concerned about privacy may want to stay informed about how their data is being handled. You can read more about data privacy and biometric data on this page.

The Future of Biometric Verification for JazzCash and EasyPaisa Users in Pakistan

Biometric verification for JazzCash and EasyPaisa users is just the beginning of a larger trend in securing digital financial transactions in Pakistan. As mobile financial services grow, more companies are likely to adopt similar verification methods to ensure user security and compliance with regulations.

In the coming years, we may see the integration of additional security measures, such as voice recognition, iris scanning, and behavioral biometrics, to further enhance the security of mobile wallets and digital payments. This shift will contribute to the development of a safer digital economy in Pakistan. Explore more on the future of biometric authentication.

ALSO SEE: NADRA Introduces New Features: 5 Exciting Innovations Revolutionizing Digital Identity in Pakistan

Conclusion: A Secure Future for JazzCash and EasyPaisa Users

Biometric verification for JazzCash and EasyPaisa users is a crucial step toward ensuring the safety and security of digital financial transactions in Pakistan. With the rise of digital payments, ensuring that these services are protected from fraud and unauthorized access has become essential. While the transition to biometric verification may take some getting used to, the benefits in terms of security, convenience, and compliance with regulatory standards are undeniable.

To avoid any disruptions in service, users are encouraged to complete the biometric verification process as soon as possible. JazzCash and EasyPaisa are making the process as simple and accessible as possible, ensuring that all users can enjoy secure and seamless transactions moving forward. With the implementation of biometric verification, users can have greater peace of mind knowing that their financial information is protected by one of the most secure forms of authentication available today.