How to Create PayPal Account in Pakistan in 2025: Step-by-Step Guide and Alternatives

Create PayPal Account in Pakistan – PayPal is the global standard for online payments, widely recognized for its security, convenience, and international reach. Whether you’re a freelancer, entrepreneur, or online shopper, PayPal is often the go-to payment platform for sending and receiving money globally. However, as of 2025, PayPal’s services remain unavailable in Pakistan, which presents challenges for users wanting to conduct international transactions.

This comprehensive guide provides clear, actionable steps for creating and using a PayPal account in Pakistan, including the necessary workarounds, alternative platforms, and tips for ensuring your account remains safe and legitimate. By following this step-by-step guide on how to Create PayPal Account in Pakistan, you can explore the potential of PayPal even without direct support.

Why is PayPal Important for Pakistan?

The rise of freelancing, online business, and digital entrepreneurship in Pakistan underscores the demand for reliable online payment systems. PayPal’s popularity can be attributed to the following reasons:

- International Reach

PayPal is accepted by millions of merchants, freelancers, and service providers globally, making it a crucial tool for international transactions. Popular freelance platforms like Upwork, Fiverr, and Freelancer rely heavily on PayPal for payments. - Security

PayPal offers a highly secure platform for transferring funds. With features such as fraud protection, buyer and seller dispute resolution, and advanced encryption technologies, it’s a trusted choice for millions worldwide. - Ease of Use

Transferring money on PayPal is incredibly simple. All it takes is an email address and a few clicks to send or receive payments from anywhere in the world. - Currency Conversion

PayPal handles currency conversions seamlessly. For cross-border transactions, this is particularly valuable as it simplifies the process of converting currencies and managing international payments. - Trusted Platform

Global businesses and clients often prefer PayPal due to its reputation and reliability, making it a widely trusted option for freelancers and businesses alike.

The PayPal Pakistan Dilemma: What You Need to Know in 2025

Although PayPal remains unavailable in Pakistan, understanding the platform’s policies and how it functions can help you navigate the system and make the most of what is available.

What Does “Not Supported” Mean?

When a country is labeled as “not supported” by PayPal, it implies:

- Users cannot register a PayPal account under that country’s name.

- Pakistani bank accounts and credit/debit cards cannot be linked to PayPal.

- Withdrawal of funds to local Pakistani bank accounts is blocked.

- PayPal may suspend or restrict accounts associated with unsupported countries.

Why Doesn’t PayPal Support Pakistan?

Several key reasons contribute to this situation:

- Regulatory and Compliance Issues: PayPal needs to obtain the necessary licenses and comply with local financial regulations, which it hasn’t done in Pakistan.

- Financial Infrastructure: Local banking and payment systems in Pakistan are not fully integrated with global financial platforms like PayPal.

- Risk and Fraud Management: PayPal assesses financial risks in countries with a higher propensity for fraud, making it difficult for PayPal to establish operations in certain regions.

Has This Changed in 2025?

As of 2025, PayPal has not officially entered the Pakistani market. However, discussions and regulatory negotiations continue, leaving room for future changes. In the meantime, workarounds and alternative platforms are available for users in Pakistan who are looking to Create PayPal Account in Pakistan.

How to Create PayPal Account in Pakistan — Step by Step

While PayPal doesn’t directly support Pakistan, it’s still possible to create and use a PayPal account by following these steps.

Step 1: Visit PayPal’s Official Website

To Create PayPal Account in Pakistan, go to PayPal.com and click the Sign Up button to begin the account creation process.

Step 2: Select the Right Account Type

You’ll be prompted to select between:

- Personal Account: Best for individuals who want to shop online or send money to friends and family.

- Business Account: Ideal for freelancers, businesses, or those who need to send invoices and receive payments.

Tip: For Pakistan-based freelancers and businesses, the Business Account is generally recommended as it offers more features and flexibility when you Create PayPal Account in Pakistan.

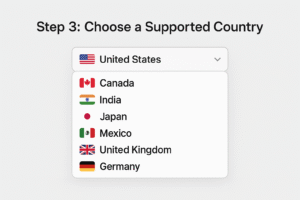

Step 3: Choose a Supported Country

Since PayPal does not support Pakistan, you need to choose a country where PayPal is available. Here are common choices:

- United Arab Emirates (UAE)

- United States (USA)

- United Kingdom (UK)

- Canada

Important: You must select a country where you have legal residency or a business registration. Using false information can lead to PayPal suspending or permanently banning your account. This is critical when you are trying to Create PayPal Account in Pakistan.

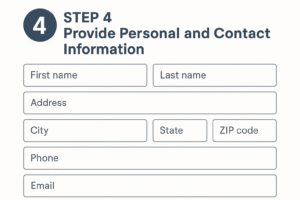

Step 4: Provide Personal and Contact Information

Fill in your personal details:

- Full Name (must match your government-issued identification)

- Email Address (ensure it is professional and accessible)

- Phone Number (with the correct country code)

- Residential/Business Address in the country you’ve selected

If you don’t have a physical address in the selected country, some people use the address of a friend or relative or use virtual office services.

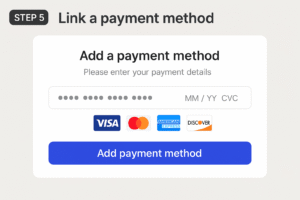

Step 5: Link a Payment Method

To fully activate your PayPal account and use it for withdrawals, you need to link a valid payment method:

- International Credit or Debit Card: Visa, MasterCard, or American Express from banks in the supported country.

- Virtual Cards: Some fintech companies offer virtual cards that can be linked to PayPal.

- Bank Account: If you have a bank account in the supported country, you can link it for additional functionality.

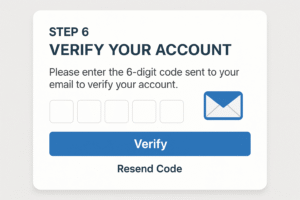

Step 6: Verify Your Account

PayPal will make a small, refundable charge (typically under $2) to your linked bank or card. This charge will include a unique verification code that you need to enter into your PayPal account to confirm ownership.

Verification Benefits:

- Removes limits on sending and receiving funds

- Confirms your identity

- Increases account security

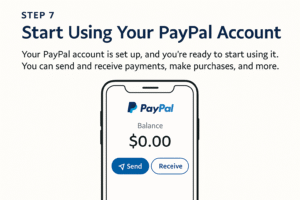

Step 7: Start Using Your PayPal Account

Once your account is verified, you can:

- Send payments to anyone globally

- Receive payments from clients or customers

- Shop online on websites that accept PayPal as a payment method

How to Withdraw Money from PayPal in Pakistan?

PayPal does not allow direct withdrawals to Pakistani bank accounts. However, there are workarounds available to access your funds.

Common Workarounds for Withdrawals

- Use Payoneer as a Bridge

Payoneer is an excellent solution for freelancers in Pakistan. Here’s how it works:

- Link PayPal to Payoneer: Payoneer provides users with a US bank account.

- Transfer Funds: Transfer your PayPal funds to Payoneer.

- Withdraw to Pakistani Bank: Once funds are in Payoneer, you can withdraw them to your local bank account in Pakistan.

This method is widely used and remains legal for Pakistani freelancers and businesses.

- Use International Bank Accounts or Cards

If you have a bank account or card in the supported country, you can withdraw your PayPal funds there and then transfer them to Pakistan via legal banking channels or other transfer methods. - Use Currency Exchange Platforms

Some users resort to online currency exchange platforms or digital wallets to move their funds from PayPal to local accounts. Make sure to exercise caution and verify the legitimacy of these platforms before using them.

Alternatives to PayPal in Pakistan

Since PayPal is not available in Pakistan, here are some reliable alternatives:

Payoneer – Create PayPal Account in Pakistan

- Provides a US bank account number and a prepaid Mastercard.

- Accepts payments for freelancing and e-commerce.

- Allows local currency withdrawals in Pakistan.

Skrill – Create PayPal Account in Pakistan

- Supports sending and receiving money in Pakistan.

- Often used for online trading, gambling, and gaming platforms.

JazzCash & Easypaisa – Create PayPal Account in Pakistan

- Local mobile wallets gaining traction for international payments.

- Integrated with some international payment gateways.

Local Bank Wire Transfers – Create PayPal Account in Pakistan

- Banks like HBL, UBL, and MCB offer international wire transfer services.

- Slower and typically higher fees but provides a secure option for receiving payments.

Important Tips for Pakistani PayPal Users in 2025

- Avoid False Information: Never provide fake details (addresses or names), as this could lead to a permanent ban on your account.

- Use Trusted Payment Methods: Stick to reliable international cards and avoid prepaid cards from unreliable sources.

- Keep Your Account Updated: Regularly update your PayPal information to avoid account freezes or complications.

- Be Wary of Scams: Some services promise to create PayPal accounts for you but may be fraudulent. Always use official channels.

- Stay Informed: PayPal’s policies can change, so stay updated on any developments related to PayPal in Pakistan.

Frequently Asked Questions (FAQs)

Q1: Can I use PayPal in Pakistan to shop online?

Yes, once your PayPal account is verified and linked to an international card, you can shop on websites that accept PayPal.

Q2: Can I send money from Pakistan to other countries via PayPal?

Yes, once you set up your PayPal account and verify it, you can send payments globally.

Q3: Can I receive payments on PayPal in Pakistan?

You can receive payments, but withdrawing them directly to Pakistani bank accounts requires workarounds like Payoneer.

Q4: Is it legal to create a PayPal account with another country’s address?

Yes, it is legal as long as you have a valid connection to that country, such as a business or residency. Using false details violates PayPal’s terms.

Q5: When will PayPal officially launch in Pakistan?

There is no official timeline yet, but discussions are ongoing, and it remains a possibility in the future.

ALSO SEE: How to Create a UK TikTok Account from Pakistan (2025 Guide)

Conclusion – Create PayPal Account in Pakistan

Although PayPal is not officially supported in Pakistan as of 2025, it remains an essential tool for freelancers, businesses, and digital entrepreneurs. By following the outlined steps and using workarounds like Payoneer, Pakistanis can still access PayPal’s benefits. Additionally, alternative platforms such as Payoneer, Skrill, and local bank wire transfers provide viable options for receiving international payments.

As Pakistan’s fintech ecosystem continues to evolve, more payment options may become available in the future. Stay informed and use trusted methods to ensure a smooth experience with PayPal and other global payment platforms.

Hi there.

peshawartech.com, I appreciate the care you put into this space—it really shows.

I recently published my ebooks and training videos on

https://www.hotelreceptionisttraining.com/

They feel like a hidden gem for anyone interested in hotel and management. These ebooks and videos have already been welcomed and found very useful by students in Russia, the USA, France, the UK, Australia, Spain, and Vietnam—helping learners and professionals strengthen their real hotel reception skills. I believe visitors and readers here might also find them practical and inspiring.

Unlike many resources that stay only on theory, this ebook and training video set is closely connected to today’s hotel business. It comes with full step-by-step training videos that guide learners through real front desk guest service situations—showing exactly how to welcome, assist, and serve hotel guests in a professional way. That’s what makes these materials special: they combine academic knowledge with real practice.

With respect to the owners of peshawartech.com who keep this platform alive, I kindly ask to share this small contribution. For readers and visitors, these skills and interview tips can truly help anyone interested in becoming a hotel receptionist prepare with confidence and secure a good job at hotels and resorts worldwide. If found suitable, I’d be grateful for it to remain here so it can reach those who need it.

Why These Ebooks and Training Videos Are Special

They uniquely combine academic pathways such as a bachelor of hospitality management or a advanced hotel management course with very practical guidance on the front desk agent description. They also cover the hotel front desk job description, and detailed hotel front desk duties and responsibilities.

The materials go further by explaining the reservation systems in hotels, check-in and check-out procedures, guest relations, and dealing with guest complaints—covering nearly every situation that arises in the daily business of a front office operation.

Beyond theory, my ebooks and training videos connect the academic side of resort management with the real-life practice of hotel front desk duties.

– For students and readers: they bridge classroom study with career preparation, showing how hotel management certificate programs link directly to front desk skills.

– For professionals and community visitors: they support career growth through questions for receptionist, with step-by-step questions to ask a receptionist in an interview. There’s also guidance on writing a strong receptionist description for resume.

As someone who has taught hotel and management courses for nearly 30 years, I rarely see materials that balance the academic foundation with the day-to-day hotel front desk job requirements so effectively. This training not only teaches but also simulates real hotel reception challenges—making it as close to on-the-job learning as possible, while still providing structured guidance.

I hope the owners of peshawartech.com, and the readers/visitors of peshawartech.com, will support my ebooks and training videos so more people can access the information and gain the essential skills needed to become a professional hotel receptionist in any hotel or resort worldwide.

Keep up the great work—your consistency matters.